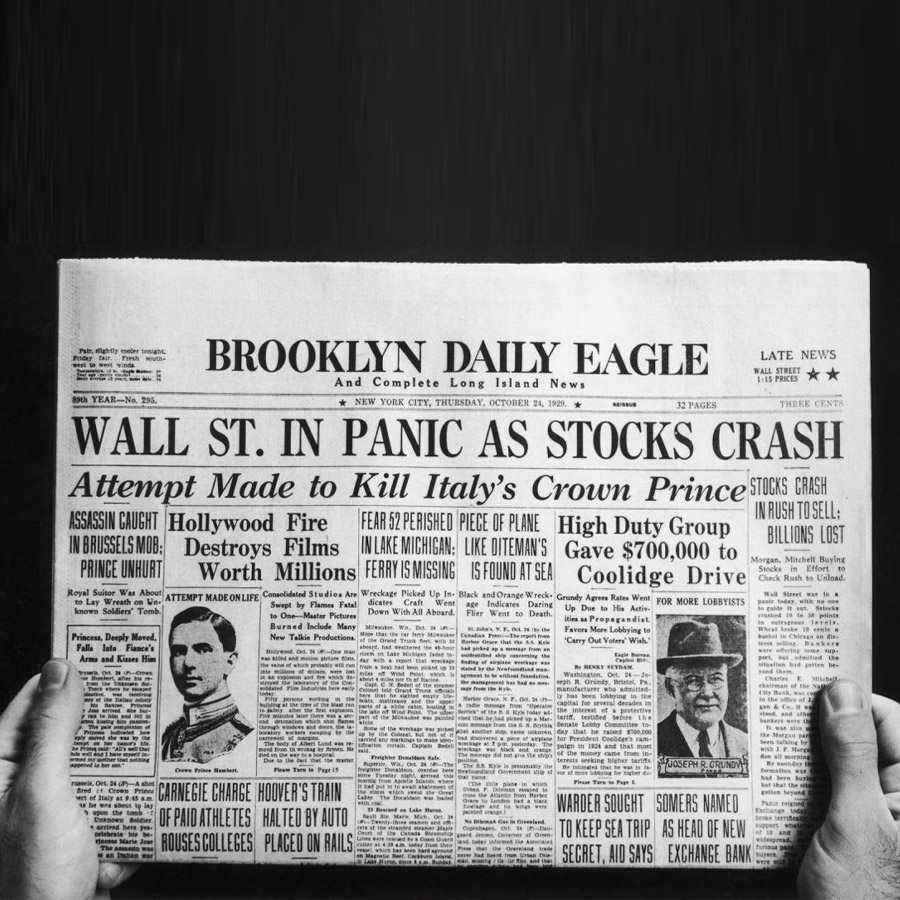

October 24, 1929, is remembered as "Black Thursday" — the day Wall Street faced a catastrophe that not only collapsed the stock market but also devastated the U.S. economy. This crisis marked the beginning of the Great Depression, serving as an important lesson for future generations of investors and business people. Let’s examine what happened that day and what lessons we can draw from it.

How It All Began

The 1920s are known as the "Roaring Twenties" — a time filled with consumer optimism, technological advancements, and cultural growth. The economy was thriving, the gross national product steadily increased, and businesses prospered. However, beneath this apparent stability were troubling signs. Economists predicting a crash noted record levels of production, which led to overproduction of goods and falling stock prices. While ordinary citizens celebrated success, some bankers and analysts, ironically, ignored the warnings and continued to invest in the market.

On the Day of the Catastrophe

When Black Thursday arrived, Wall Street brokers were glued to their phones. Hundreds of shareholders were trying to sell their stocks at any price. In panic, brokers rushed around the offices, shoving and removing their jackets — fear and uncertainty were escalating with every passing moment. Ultimately, the stock market plummeted by a staggering 90%, marking the beginning of a prolonged economic depression.

Interestingly, Winston Churchill was in New York that day. He oddly found himself on Wall Street at the moment brokers were trying to salvage the situation. Ironically, he lost a fortune on devalued stocks, which ultimately became symbols of the crash.

Positive Forecasts and Financial Uncertainty

Despite the growing panic, many bankers insisted on reassuring the public about the market's stability. On the evening of October 24, they issued a joint statement claiming that, overall, the situation on the exchange was stable, and financially, things were better than ever. These optimistic statements, much like the predictions of a potential crash, went unheard.

Unfortunately, following Black Thursday came Black Friday, Black Monday, and Black Tuesday. The economy was plunged into a deep crisis that lasted a whole decade.

Lessons for the Future

What can we learn from this tragic history? Firstly, it's crucial to be attentive to the signals the economy sends. Ignoring warning signs can lead to catastrophic consequences. Secondly, one should never blindly trust positive forecasts and expectations, especially when a multitude of facts and data points to the contrary. Finally, be ready for change. The financial market is unstable and demands flexibility and adaptability from investors.

Black Thursday became not only a symbol of economic catastrophe but also an important lesson for future generations. History teaches us to be more cautious and attentive to changes in the financial world. By learning from past mistakes, we can better prepare for potential challenges in the future.